Setting Up an Offshore Business in Mauritius: 2024 Guide

Catégorie : Articles

Setting up an Offshore Company in Mauritius – Process & Advantages

Mauritius has gone out of its way to gain a solid reputation as a secure and reliable investment destination when it comes to stable governance, transparency, ethics, economic, and political freedom. And this is why we’ve seen so many offshore companies flourishing in Mauritius during the past years. In Mauritius, offshore companies are called Global Business companies. If you too are thinking of expanding your company operations overseas and have thought of Mauritius, we have some good news for you. In this article, we’ll outline the advantages of setting up your offshore company in the Mauritius International Financial Centre.

Why Mauritius is an Ideal Destination for Foreign Investors

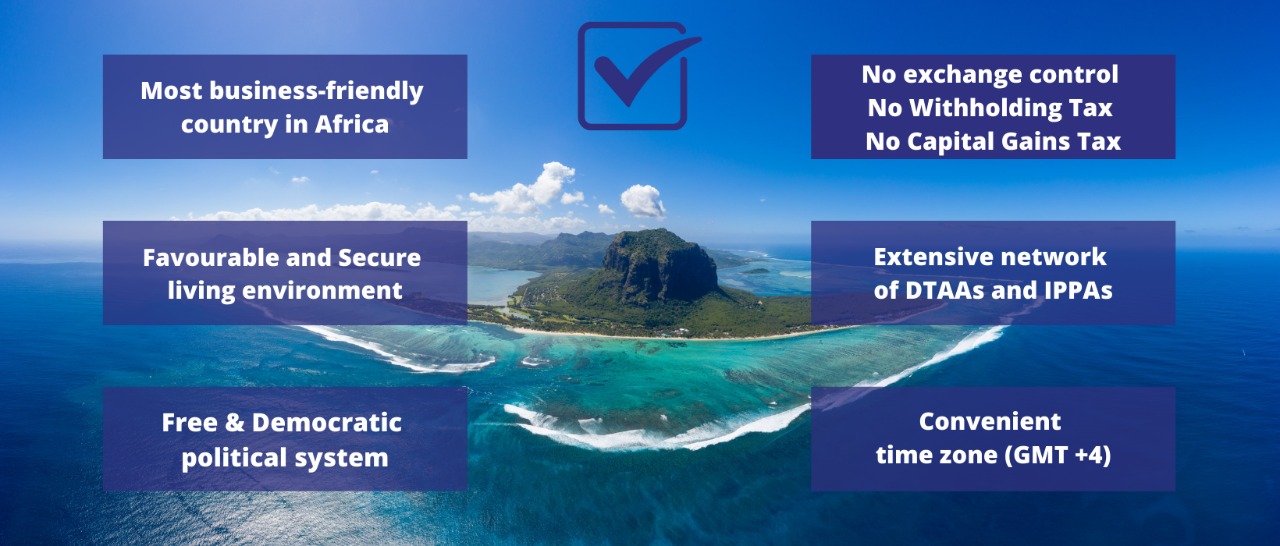

Mauritius, strategically positioned at the crossroads of Asia, Africa, and Europe, has long been a beacon for international trade and investment. Today, it stands as a testament to stability and growth, consistently ranking as the most stable country in Africa since 2005 according to the Fund for Peace. Recognized as the top country in Africa for ease of doing business by the World Bank, Mauritius offers a plethora of advantages to foreign investors. Its dual legal system merges the best of Common and Civil Law, ensuring a robust legal framework. The island nation boasts a favorable and secure living environment, complemented by a free and democratic political system. Financially, Mauritius is attractive with no exchange control, no withholding tax, and no capital gains tax. Additionally, its extensive network of Double Taxation Avoidance Agreements (DTAAs) and Investment Promotion Protection Agreements (IPPAs) further solidify its position as a prime investment hub. With its strategic geographic location, a convenient time zone (GMT +4), and a blend of both anglophone and francophone educational institutions, Mauritius presents a holistic environment that seamlessly blends business opportunities with an unparalleled quality of life.

Advantages of setting up an offshore company in Mauritius

Mauritius, being the leading country in Africa (13th internationally) for ease of doing business, and for Good Governance (Ibrahim Index of African Governance – IIAG), presents a plethora of advantages to foreign entrepreneurs, investors, consultants and multinational companies who want to set up an offshore company. Mauritius also ranks 2nd among Middle-Income economies, behind Malaysia which also scored 81.5 points, like Mauritius. Mauritius DTAA agreements are fully based on the OECD and UN Model and have been negotiated bilaterally with partner countries founded on mutual understanding. With its extensive network of Double Taxation Avoidance Agreements (DTAAs) and Investment Promotion Protection Agreements (IPPAs), Mauritius has a safe, flexible, and reliable jurisdiction.

Mauritius also has a harmonised tax system. It is true that Mauritius offers a range of incentives that reduces or even nullifies the tax rates and these are provided largely with the view of boosting the competitiveness of the jurisdiction in terms of facilitating business in the country. While it applies a 15% tax rate for corporate and individuals, there is no Withholding Tax on dividends, no Capital Gains Tax, no Inheritance Tax and no capital duty on issued capital. The country respects all international standards in terms of compliance (with strict KYC and AML regulations), and institutions respect the confidentiality of company information and allow free repatriation of profits and capital.

Other advantages of setting up an offshore company in Mauritius also include:

- Most business-friendly and investment-friendly country in Africa;

- Dual legal system, combining the advantages of Common and Civil Law;

- Strategic location and convenient time-zone (GMT +4);

- Free and democratic political system;

- Presence of internationally recognised banks;

- Easy procedures from company re-domiciliation;

- No exchange control;

- No restrictions on trading;

- Extensive network of DTAAs and IPPAs;

- A pool of highly qualified bilingual professionals; and

- Privacy and security of information.

Requirements to set up an offshore company in Mauritius

Investors and entrepreneurs wishing to set up an offshore company in Mauritius have two options – set up a Global Business Company or an Authorised Company. While an Authorised Company is the classic offshore business, the GBC is a tax resident entity that can benefit from an 80% exemption (subject to meeting the prescribed activities for exemption and substance conditions) of corporate income tax. The formalities, procedures and documentation prior to the formation of an offshore company are generally completed within a week.

Global Business Company

The GBC (formerly known as GBC1) is registered under the Companies Act 2001 and licensed by the Financial Services Commission (FSC). Apart from the classical uses of GBC companies for investment holding activities, trading, consultancy services, etc, investors can open a GBC in Mauritius to be used for Financial Services business (though it is subject to additional licensing conditions).

The GBC license allows the offshore company to conduct business outside Mauritius while benefiting from the network of DTAAs. As mentioned above, most of the GBC is used for financial management purposes. Some of the popular uses include:

- Asset management and Treasury management

- Credit finance

- Custodian services

- Leasing

- Factoring

- Occupational pension scheme

- Pension fund administrators and pension scheme management

- Retirement benefits scheme

- Registrar and transfer agent

- Etc

The requirements for setting up a GBC in Mauritius mainly include:

- A minimum of one shareholder (likewise if the company is a wholly-owned subsidiary);

- A minimum of two qualified directors residing in Mauritius;

- Board meetings must be held in Mauritius;

- Main bank account to be held in Mauritius;

- Have physical offices in Mauritius where accounting records and statutory documents including register of members, debenture holders, and officers must be kept;

- Appoint a local management company, like Nexus Global Financial Services Limited, to act as the middle man between the GBC and the FSC;

- Must file audited profit and loss account and balance sheet annually with the FSC within 6 months of the financial year-end;

- Tax returns must be filed with income tax authorities; and

- Have a company clause stating that disputes shall be solved by arbitration in Mauritius.

Authorised Company

The Authorised Company (AC) is introduced in the Finance Act 2018 (Miscellaneous Provisions). The Global Business sector in Mauritius is in compliance with international standards (particularly OECD’s BEPS Action Plan).

The Authorised Company is a relatively new type of company that has its business activities, as well as the control and management, being carried out outside of Mauritius. As such, the Authorised Company’s income will not be subject to tax in Mauritius. However, unlike the GBC, an Authorised Company cannot benefit from the network of DTAAs that Mauritius has with various countries.

An Authorised Company shall have, at all times, a Registered Agent in Mauritius, which shall be a management company. Nexus Global Financial Services Limited is duly licensed by the FSC to act as a management company in Mauritius and has the experience to accompany you in the formation of your offshore company. Our duties towards Authorised Companies, as a Registered Agent, comprise:

- File the return of income with the Mauritius Revenue Authority (MRA);

- File a financial summary with the FSC;

- Safely store the records (including board minutes and resolutions, transaction records, and other documents as stated by the FSC); and

- Tackle measures to prevent money laundering and terrorist financing, and any other similar offenses as stated by the FSC.

According to the law, an Authorised Company is eligible for doing business in the following categories:

- Investment holding and Property holding;

- International Trading;

- Management and Consultancy;

- IT services;

- Logistics;

- Marketing; and

- Shipping and Ship management.

The main requirements to set up an Authorised Company include:

- Minimum of one shareholder;

- Copy of ID and/or passport, and proof of the residential address;

- Minimum paid-up capital of one share;

- Shall have a registered agent in Mauritius (i.e. management company like Nexus Global Financial Services Limited);

- File annual tax return with the MRA;

- File financial summary with the FSC;

- Appointment of one director (Mauritian or foreigner);

- Have a registered office in Mauritius;

- May hold meetings in any country and may attend such meetings by electronic means;

- Main bank account does not need to be in Mauritius; and

- Due diligence: Promoters, beneficial owners/shareholders, directors, bank account signatories.

However, it is important to note that an Authorised Company is not allowed to engage in the following activities:

- Financial services (including banking);

- Holding, managing, or dealing with a Collective Investment Scheme (or Fund) as a professional administrator;

- Providing registered office facilities, or nominee, directorship and secretarial services, or other services to corporations; or

- Providing trusteeship services.

Want to set up your offshore company in Mauritius to benefit from all those advantages listed above? GET IN TOUCH, and our professional team will be glad to guide you throughout the whole process.