Company Redomiciliation to Mauritius – Process & Advantages

Catégorie : Articles

Redomiciling your Company to Mauritius

Nexus Global Financial Services (Nexus) offers services of redomiciling offshore companies to Mauritius. This procedure means changing the country of incorporation, while keeping all existing business relations and track records. For an offshore company to continue in another jurisdiction, redomiciliation must be permitted by the legislation of the country where the company is incorporated, as well as by its Memorandum and Articles of Association (if any). It is worth noting that not all countries permit redomiciliation.

Why will you choose to redomicile a Company?

The question of redomiciliation of the company registered in one country to another jurisdiction becomes relevant if the current country changes the regulatory conditions of company operations such as its tax rate, or if the presence of the company in the original country of domicile is unsustainable for other reasons.

In such situations, the easiest option is to incorporate a new company in another country and to forget the “old” company. However, this is not always possible for companies who still want to keep a track record.

This will depend entirely on the circumstances of the existing company and the following factors will probably decide this:

1. The existence of contracts that will be difficult to be negotiated again.

2. The existence of assets held by the company in the outgoing jurisdictions e.g. property which may be expensive and time-consuming to sell and buy back.

3. Existing bank accounts

If one or more of the above factors are applicable, it is probably worth considering re-domiciling the company.

If not, it will probably be more cost-effective to simply close the “old” company and establish a new one.

How does the redomiciliation process work?

The re-domiciliation procedure may have particular differences in each country, but generally, it will include the following steps:

- A company incorporated in one country should be in good standing status as at the moment it will redomicile, so where this country has the relevant requirements in place for this process, the company files statements, pays all fees applicable as at the moment of redomiciliation and orders a certificate of good standing from the registrar of companies or equivalent.

- The company signs minutes of re-domiciliation to confirm that the relevant decision has been taken by the board on the company’s re-domiciliation to another jurisdiction.

- The above minutes are certified and Apostilled and sent to the new jurisdiction together with the certificate of good standing, legalised copies of the certificate of incorporation and the articles of association.

- After the above documents are received by and accepted into the new jurisdiction, the register of companies will issue a certificate of continuation to confirm that from the date of issue the company is incorporated in this new country and subject to its legislation.

- After the new country recognises the fact of the company’s re-domiciled, the remaining procedures should be carried out to strike off the company from the register of the first country of incorporation on the basis of its redomiciliation.

It is interesting to note that Mauritius allows redomiciliation of various corporate structures such as companies, foundations, trusts, funds, etc.

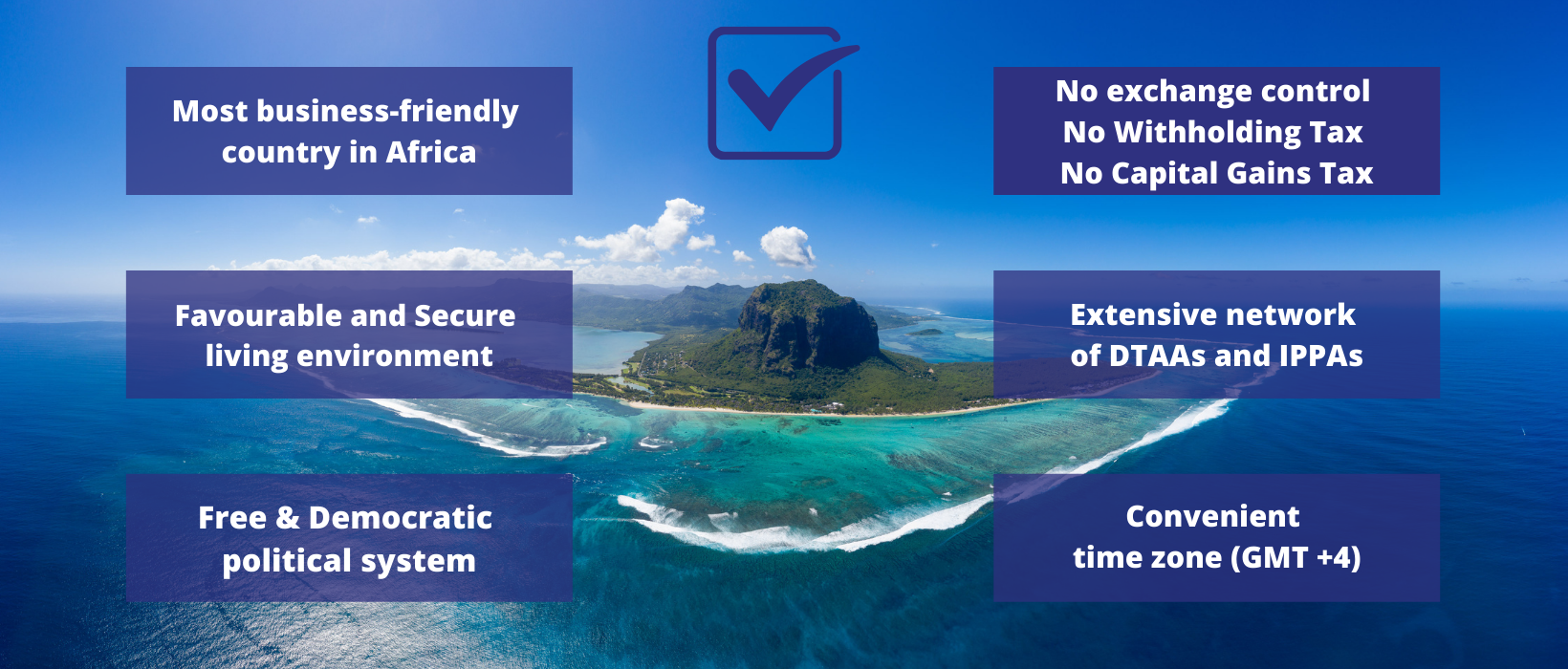

Why choose Mauritius?

There are various reasons why a company would want to redomicile to Mauritius, including taking advantage of the existing attractive taxation system, the reliable infrastructural facilities and a wide array of reputable and regulated financial services.

Once re-domiciled, the company is treated as a company ordinarily resident and domiciled in Mauritius.

As company structure options, re-domiciliation to Mauritius can be in the form of a Global Business Company or an Authorised Company.